Day 26 - Using additive models

Last time we introduced what an additive model was and how to fit one to a

response table. Today we give some examples of analyzing data with

additive models and discuss some of the finer points.

Transformation

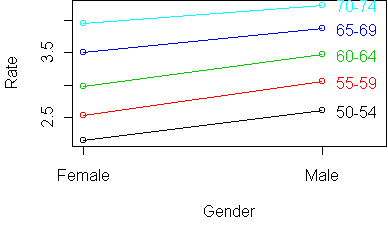

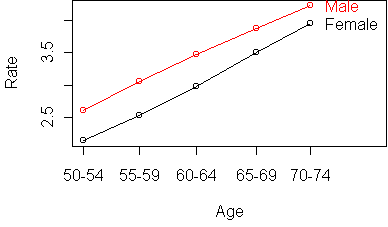

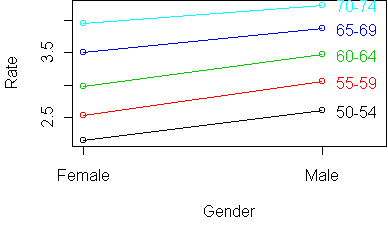

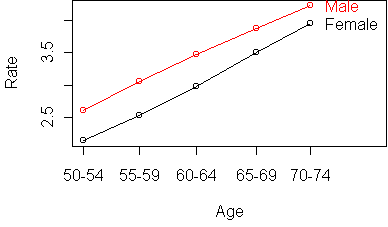

Last time we analyzed a response table of Virginia death rates:

Rate

Gender

Age Female Male

50-54 8.55 13.55

55-59 12.65 21.20

60-64 19.80 31.95

65-69 33.00 47.80

70-74 52.15 68.55

The conclusion from profile plots was that the table is nearly additive,

except that the Gender effect gets larger with Age. But there is something

suspicious about that conclusion. Looking at the table, we see that the

Gender effect for Ages 70-74 is (68.55-52.15 = 16.4) while the Gender

effect for Ages 50-54 is (13.55-8.55 = 5). This seems to support the

conclusion. But does it make sense to compare differences of rates?

As discussed on day14, rate differences can be

misleading. It is better to compare them using ratios. For Ages 70-74,

the risk ratio for Males to Females is (68.55/52.15 = 1.3) and for Ages

50-54 it is (13.55/8.55 = 1.6). So according to risk ratio, the Gender

effect decreases with Age. An additive model does not make sense on rates.

However, an additive model does make sense on log-rates, because a

difference of log-rates is equivalent to taking a ratio.

So we should have begun by taking the logarithm of the original response

table:

> z <- log(y)

> z

Rate

Gender

Age Female Male

50-54 2.145931 2.606387

55-59 2.537657 3.054001

60-64 2.985682 3.464172

65-69 3.496508 3.867026

70-74 3.954124 4.227563

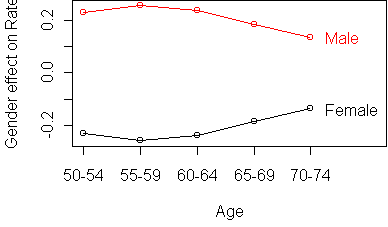

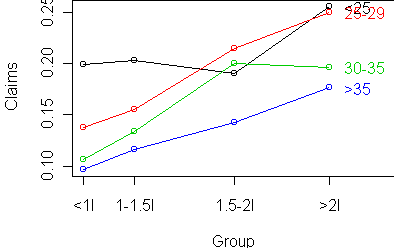

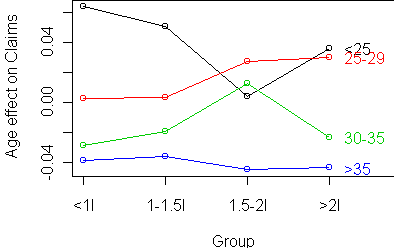

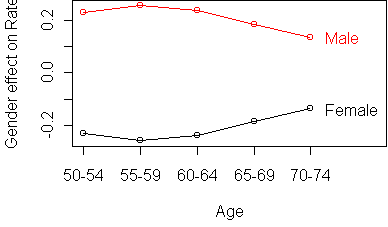

Here are the profiles:

Interestingly, the table is more additive after taking the logarithm.

Before, the Age effect increased rapidly with Age. Now all Age profiles

are equally spaced.

And the Gender effect decreases with Age instead of increasing.

The moral of the story is that you may need to transform your data before

an additive model makes sense. This wasn't a big issue when we were doing

trees, since trees only try to stratify the dataset when

there are different responses. Now transformation is an issue.

US Personal Expeditures

As another example, consider this table of US personal expenditures over the

years 1940-1960 (in billions of dollars):

Expenditure

Year

Segment 1940 1945 1950 1955 1960

Food and Tobacco 22.200 44.500 59.60 73.2 86.80

Household Operation 10.500 15.500 29.00 36.5 46.20

Medical and Health 3.530 5.760 9.71 14.0 21.10

Personal Care 1.040 1.980 2.45 3.4 5.40

Private Education 0.341 0.974 1.80 2.6 3.64

(Use dget("Expenditure.dat") to read the table into R.)

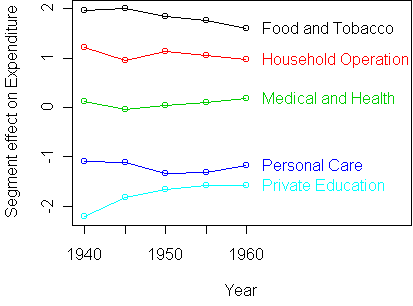

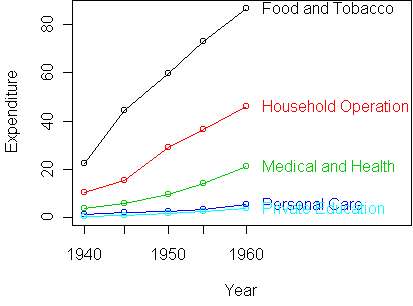

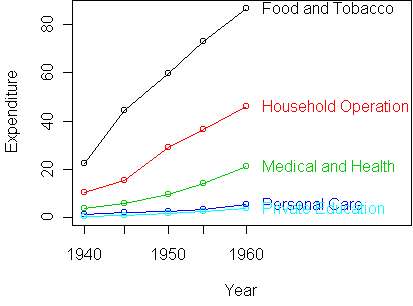

A profile plot shows that the predictors are not very additive:

However, the curves seem to be growing in a particular way. In fact,

we might be inclined to say that expenditures grow exponentially from year

to year. If this is the case, then an additive model would make much more

sense on the logarithmic scale.

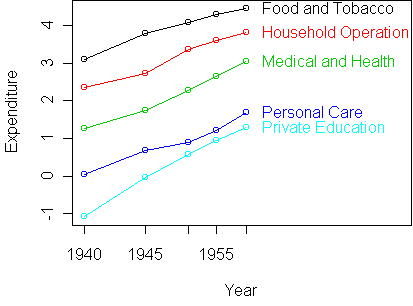

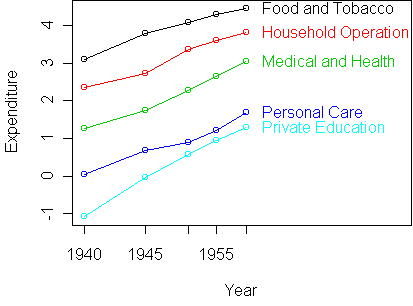

z <- log(y)

profile.plot(z)

This is clearly more additive.

In nontechnical terms, we would say that the growth rate in

expenditure over time is the same for all segments.

Equivalently, we could say that the ratio of expenditure between segments

is the same over time.

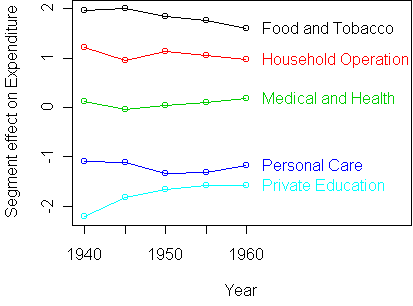

To get a better look at the deviations from

additivity, we standardize the plot:

On a standardized plot, the rows of an additive table should be horizontal.

The biggest deviation from additivity is the expenditure on Private

Education in 1940. The expenditure on Food and Tobacco in

1960 also seems low. To get a quantitative idea of the size of these

deviations, we make an additive fit and look at the residuals.

Since we don't have the original data frame, we run aov directly

on the response table:

> fit <- aov.rtable(z)

> e <- rtable(fit)

> res <- z-e

> res

Expenditure

Year

Segment 1940 1945 1950 1955 1960

Food and Tobacco 0.131 0.173 0.012 -0.0820 -0.235

Household Operation 0.153 -0.111 0.062 -0.0078 -0.095

Medical and Health 0.046 -0.118 -0.049 0.0172 0.104

Personal Care 0.113 0.103 -0.137 -0.1091 0.030

Private Education -0.443 -0.047 0.113 0.1817 0.195

> sort.cells(res)

Segment Year Expenditure

5 Private Education 1940 -0.4431

21 Food and Tobacco 1960 -0.2346

14 Personal Care 1950 -0.1374

...

The function sort.cells that we used for contingency tables is

also useful here.

Car prices

Here is an example of how additive modeling is useful when analyzing a

complex data set with many variables.

The idea is to remove dominant effects via a tree and then find pairs of

predictors which seem to have large second-order effects.

We use the car price data from day20:

Cars93 <- read.table("Cars93.dat")

# remove dominant effects via tree

tr <- tree(Price~Horsepower+Weight,Cars93)

x <- Cars93

x$Price <- residuals(tr)

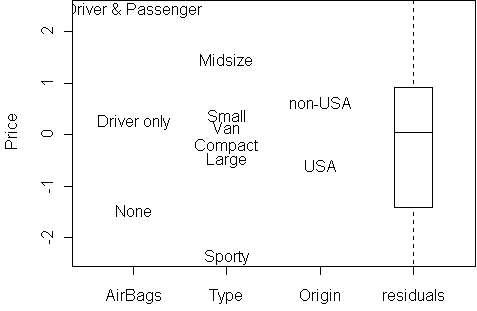

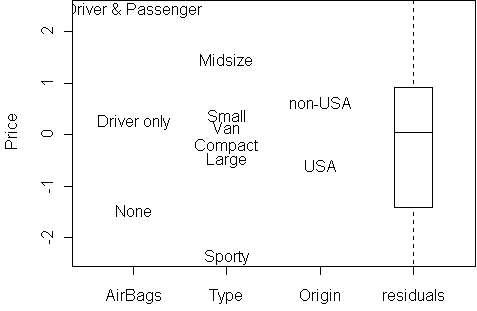

fit <- aov(Price ~ AirBags + Type + Origin, x)

effects.plot(fit)

It seems that AirBags and Type have the largest

effect. Having lots of AirBags obviously increases the Price, and so does

being an import (non-USA).

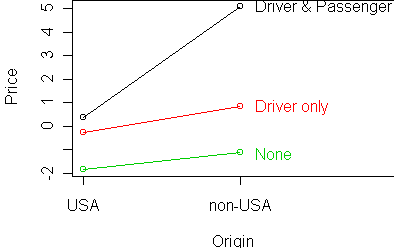

Let's look at AirBags and Origin in more detail

for predicting Price:

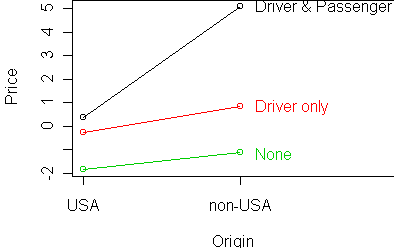

y <- rtable(Price ~ AirBags + Origin, x)

profile.plot(y)

These variables are almost additive, except for the case of Driver &

Passenger AirBags, where non-USA cars are unusually expensive (or USA

cars are unusually cheap).

Insurance claims

Our final example is a table with dramatic deviations from additivity.

The dataset records the number of insurance claims made by car owners in 1973:

District Group Age Holders Claims

1 1 <1l <25 197 38

2 1 <1l 25-29 264 35

3 1 <1l 30-35 246 20

4 1 <1l >35 1680 156

5 1 1-1.5l <25 284 63

...

Here Group means the size of the car's engine, and

Age is the age of the policy holder.

We want to model claim rate, which is the ratio of the number of claims to

the number of holders. We compute that from the ratio of two response tables:

> claims <- rtable(Claims ~ Age + Group, Insurance, sum)

> holders <- rtable(Holders ~ Age + Group, Insurance, sum)

> y <- claims/holders

> y

Claims

Group

Age <1l 1-1.5l 1.5-2l >2l

<25 0.199 0.20 0.19 0.26

25-29 0.138 0.16 0.21 0.25

30-35 0.106 0.13 0.20 0.20

>35 0.097 0.12 0.14 0.18

Notice the extra argument sum given to rtable.

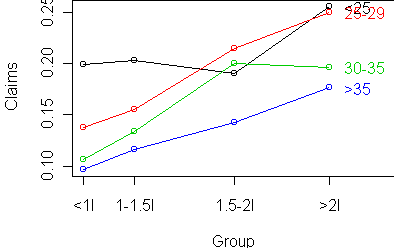

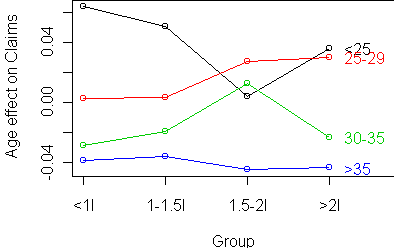

This makes each cell of the rtable equal to the total as opposed

to the mean. Here are the raw and standardized profile plots:

Interestingly, there is an increasing claim rate (risk) with engine size,

and it does seem to be additive with the risk from age.

The striking feature is what happens with 1.5-2l cars.

Age<25 has a dramatically lower risk,

while Age 30-35

has dramatically higher risk for those cars.

Code

Functions introduced in this lecture:

Tom Minka

Last modified: Tue Nov 06 18:59:06 Eastern Standard Time 2001